May 2025

Probabilities vs. Possibilities:

Where Will Markets Go From Here?

Key Takeaways

2025 Has Brought Increased Volatility

In February, the market’s positive momentum met resistance after a shift in U.S. trade policy triggered caution among investors. On February 1, the White House announced tariffs, including 25% on imports from Canada and Mexico, with a 10% exemption for Canadian energy products. Tariffs on Chinese imports were set at 10% in February but were scheduled to increase to 20% in March. The administration framed these measures as part of a broader effort to curb illegal immigration and restrict the flow of narcotics into the United States. The foreign policy shift had immediate effects on investor sentiment. The University of Michigan’s 1-year inflation expectations survey reflected a sharp rise in consumer concerns, with expectations jumping from 3.3% in January to 5% in March. Why is this important? It matters because perception drives behavior. If consumers expect prices to rise, they spend differently, affecting the broader economy.

Tariffs Trigger a Selloff

This caution became fear in early April when the U.S. administration announced an extensive list of sweeping new tariffs. While markets had priced in some tariff effects, the scope and severity caught investors off guard. A baseline 10% tariff was imposed broadly, with significantly higher effective rates targeting key trading partners. Analysts estimate that this policy shift will push the U.S. effective tariff rate to 25%, which is a level not seen since the pre-WWII era. The equity market responded with one of its most severe short-term selloffs in history. From April 2-April 4, the S&P 500 fell over 10%, joining only three other instances of a decline this significant since 1950: Black Monday in 1987, the 2008 financial crisis, and the COVID-19 economic shutdown in 2020.

Economic and Policy Implications of Tariffs

Tariffs act as a tax on imported goods, forcing businesses to either absorb the cost and reduce margins or pass it along to consumers through higher prices. Both factors are headwinds for economic growth. Some firms may relocate supply chains to offset the impact, but those shifts are neither quick nor inexpensive. This environment of uncertainty weighs heavily on business investment, consumer confidence, and market expectations.

Inflation surveys conducted before the tariff announcement already hinted at building pressure. The Richmond Fed’s business inflation expectations rose above 7% over the next six months, reaching the highest level in decades. Similarly, the University of Michigan’s one-year consumer inflation outlook climbed to nearly 5%, well above the Federal Reserve’s 2% target. These indicators are expected to rise further in the wake of the tariff announcement, complicating the Fed’s policy path.

Inflation surveys conducted before the tariff announcement already hinted at building pressure. The Richmond Fed’s business inflation expectations rose above 7% over the next six months, reaching the highest level in decades. Similarly, the University of Michigan’s one-year consumer inflation outlook climbed to nearly 5%, well above the Federal Reserve’s 2% target. These indicators are expected to rise further in the wake of the tariff announcement, complicating the Fed’s policy path.

Market Sentiment Turns Bearish

Meanwhile, investor sentiment has turned decisively negative. The CBOE Volatility Index (VIX) surged to 52, reaching its highest reading since March 2020, reflecting extreme levels of fear in the market. The AAII sentiment survey showed bearish investor sentiment reaching 62%, levels previously seen only during the 2008 crisis and the COVID-19 shock. Historically, such extreme readings have often occurred near market bottoms, but there is no guarantee of a quick recovery. In 2008, similar pessimism persisted for months before markets began to stabilize.

Market Declines of 19% or More

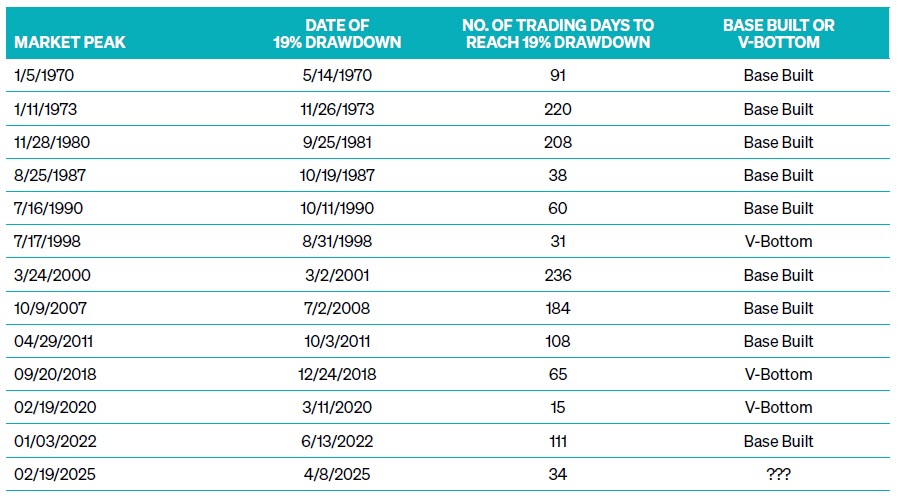

From peak to trough, the S&P 500 declined nearly 19%. Since 1970, many declines have reached 19% or more, as illustrated in FIGURE 1. The market’s most recent decline, which began in the middle of February, was the third fastest decline of 19% since 1970 because it took just 34 trading days.

FIGURE 1 | S&P 500 DECLINES 19% OR MORE: From 1970

SOURCE: BLOOMBERG, S&P 500 PRICE

What Comes Next: Base-Building or V-Bottom?

After significant market declines, history suggests two probable paths forward. The market will typically undergo a base-building process or experience a V-bottom recovery.

BASE-BUILDING CONSOLIDATION

The more common outcome following a sharp decline is a base-building consolidation process in which markets generally trade sideways in a range over several months. This time is usually beneficial for stabilizing market sentiment and fundamentals. This pattern has occurred in roughly 75% of these declines since 1970. The most recent example of the market building a base occurred in 2022, illustrated in FIGURE 2.

FIGURE 2 | S&P 500 AFTER A 19% DECLINE

SOURCE: BLOOMBERG, MEEDER

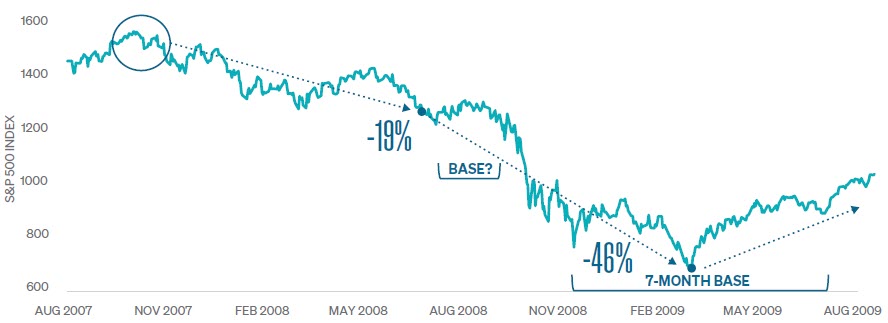

It is essential to understand that a base-building consolidation does not always occur quickly after a significant market decline and is not always constructive. One example of this happened in 2008-2009 in FIGURE 3. After the S&P 500 fell 19%, the market traded sideways for over two and a half months. Unfortunately, the base-building process was not constructive, and the market continued to fall an additional 46% before reaching its ultimate low. The market then traded rangebound for seven months before building a constructive base and going on to successfully rebound higher.

FIGURE 3 | NYSE COMPOSITE INDEX: January 1, 2021 through September 12, 2022

SOURCE: BLOOMBERG

V-BOTTOM RECOVERY

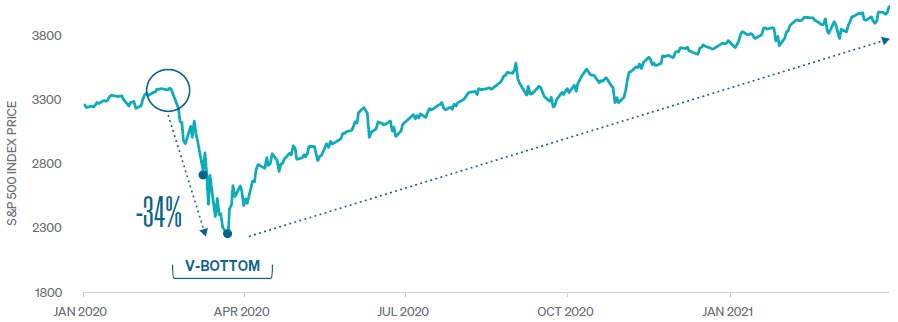

The less frequent but more dramatic bounce back is a V-bottom recovery, where stocks rebound sharply after the decline, like the shape of the letter “V.” Historically, these occurrences have been fueled by policy intervention or stimulus by central banks or a government stimulus. The most recent example occurred in 2020 during the COVID-19 pandemic, as shown in FIGURE 4.

FIGURE 4 | S&P 500 V-BOTTOM 2020

SOURCE: BLOOMBERG, MEEDER

What could lead to a quick market rebound, V-bottom recovery? A few things could easily turn the tide. The government might introduce new spending or tax breaks to support the economy, and the Federal Reserve could step in with interest rate cuts or other measures to boost confidence. Also, if the U.S. revises its trade stance or negotiates new agreements with key partners, it could ease uncertainty and help markets recover quickly. Together, these actions could spark a fast turnaround.

Looking Forward

While history offers guidance on what may occur, each cycle can unfold differently. There are a number of variables and catalysts that could impact this situation. If you have questions or would like to continue the conversation, please don’t hesitate to reach out to your investment advisor.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicit, or recommend any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Investment advisory services provided by Meeder Advisory Services, Inc.

©2025 Meeder Investment Management, Inc.

0278-MAS-5/13/25-50222