You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

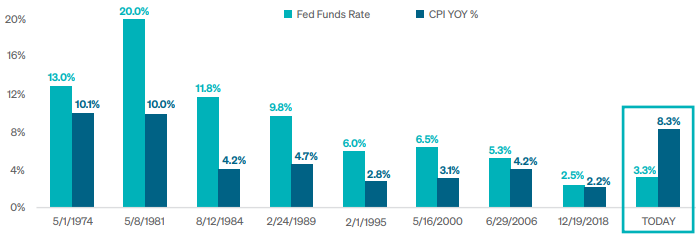

The second mandate of maintaining price stability has been the Fed’s achilleas heel. After the Fed spent months communicating that the recent spike in inflation was transitory, investors are now concerned about whether they can get inflation under control without creating an economic recession. The Fed continues to increase the overnight lending rate as their preferred method of tightening monetary policy. Just this year, the Fed has raised the rate five different times, bringing the rate from 0% to 3.25%. The Fed has remained steadfast in its commitment to controlling inflation, regardless of the consequences. Fed Chair Jerome Powell was even quoted as saying, “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.”

The Fed continued their mission of tightening monetary policy to try and contain inflation that reached a 40-year high. On September 21, the Fed raised short term interest rates 0.75%, making it the third consecutive rate hike at this level, and the fifth rate hike this year. This brought the Federal Funds rate target to 3.25%. More investors started to believe that the Fed would stick to their plan of raising short-term interest rates throughout the remainder of the year and demand for equities plummeted. Equities struggled to gain positive momentum and after significant volatility the S&P 500 Index reached a new year-to-date low. Investors that remained invested in the Growth Strategy experienced more volatility than our Defensive Equity strategies and achieved performance similar to the equity market as represented by the S&P 500 Index.

At the beginning of the quarter, the strategy had a 41% allocation to equities. By the end of July, indicators in the short-term model showed the ratio of advancing stocks to declining stocks steadily improving. This improvement led us to increase the target equity allocation to 50%. In the latter part of August, the intermediate-term model showed an increase in the demand for mutual funds. There were also bullish signs of stock newsletter sentiment and options activity that contributed to the model score and guided us to increase the target equity allocation to 55%. In September, market risk elevated as the Fed implemented their third rate-hike of 0.75%. Momentum and trend indicators deteriorated throughout the month and led us to gradually reduce the equity exposure to 41% by quarter end.

The average equity exposure throughout the quarter was 47%. By having a target equity exposure below 50% throughout the quarter, investors were protected from much of the market volatility that occurred relative to those that were fully invested.

The credit models pointed toward further weakness in credit spreads and price trends, leading the portfolios to have very little exposure to the high yield or emerging market sectors. Volatility factors were also elevated as rates rose, causing the duration models to trend toward shorter maturity exposure. Therefore, we sold longer duration Treasuries and shortened duration in the exposure to investment grade bonds. As volatility subsided early in August and a Fed pivot began to be priced into the market, the duration model signaled we should increase the duration in the portfolio. Duration was marginally extended in the funds but was then reduced for the rest of the quarter as rate volatility and direction caused the model to continue to point to a short duration profile.

Many of the factors for the sector models remained weak into September, leading us to maintain zero percent exposure to high yield and emerging markets. This also led to a very conservative profile in investment grade bonds to end the quarter.

The allocation to investment grade bonds remained relatively steady throughout Q3, but the average duration was decreased as well as a reduction to certain funds with allocations to sectors outside the model parameters.

Sincerely,

ROBERT S. MEEDER

PRESIDENT AND CEO

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0107-MIM-10/12/22-28808