You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

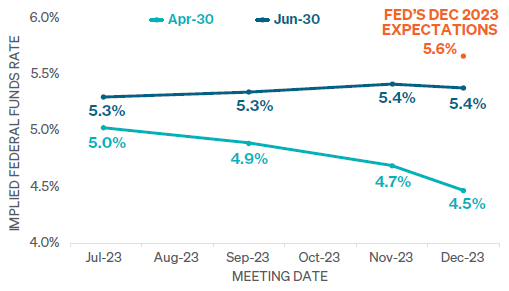

The Federal Reserve held its widely anticipated June meeting, where Chair Jerome Powell discussed the future of interest rates. The committee met investor expectations by announcing a pause in interest rate increases and keeping the target Federal Funds rate at 5.00-5.25%. Conversely, investors were surprised that the committee’s December interest rate expectations shifted noticeably higher from 5.1% to 5.6%, inferring that additional interest rate increases will likely occur later in 2023. After the surprise, investors shifted their rate expectations higher, but according to Bloomberg, the market’s implied Federal Funds rate still remains shy of the Fed’s December forecast. Exhibit 1 illustrates that as of June 30, the Fed expects to raise interest rates before year-end, while the market believes that the Fed will cut rates.

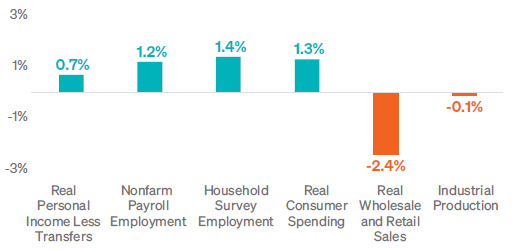

When looking more broadly, the National Bureau of Economic Research reviews six key factors when determining if the economy is in a recession. As of June 30, real wholesale plus retail sales and industrial production were the only two categories that experienced a negative percentage change in the last six months. These additional factors indicate that the economy still maintains substantial strength.

The IPS model indicated an equity target exposure of 53% to begin the second quarter. Positive equity market gains were substantial during the quarter and strengthened short- and long-term trend and momentum factors turning the short- term model score positive. This improvement caused us to increase the portfolio’s equity exposure to as high as 70% by the middle of April. The IPS model score strengthened as risk in the equity market dropped below 17, but contrarian indicators such as newsletter sentiment became more bullish and negated most of this improvement. We ended April with our equity exposure at 72%.

In early May, CPI for April came in slightly lower and initial jobless claims were higher than projected. Investor expectations increased around the possibility that a Fed rate cut could come sooner than expected. This pessimistic sentiment, which we view from a contrarian perspective, led to improvements in an already robust intermediate-term model score. Therefore, we increased our equity exposure to 80% toward the end of May.

By mid-June, the long-term model score improved to levels not seen in two years. This improvement was from continued strength in leading macroeconomic indicators and global equity trends. Additionally, all ten momentum indicators in the short-term model turned positive. The combination of these factors led us to increase our equity allocation to 90%, which remained through the end of the second quarter.

Short-duration and low credit quality was the name of the game in Q2. U.S. investment-grade bonds produced negative returns, as rates increased during the second quarter. For example, the U.S. 10-year Treasury yield moved from 3.3% to 3.8%. This rate increase allowed the short-duration position within our fixed income strategy to shine, while our exposure to emerging markets and high yield during the quarter was additive relative to holding U.S. investment-grade bonds.

The duration of the fixed income strategy has increased in 2023 but remains shorter than its respective benchmark throughout the second quarter. Our credit quality models were both risk-on at the beginning of the quarter, leading to exposure in both high-yield and emerging markets fixed-income sectors. The bond market experienced some whipsaw during the quarter, which led to a slight decrease in both emerging markets and high-yield exposure during the month of May. Both models ultimately reversed course in early June and the tactical fixed income strategy ended the quarter with an overweight to both areas of higher credit risk.

©2023 Meeder Investment Management, Inc.

0107-MIM-7/14/23-35633