You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

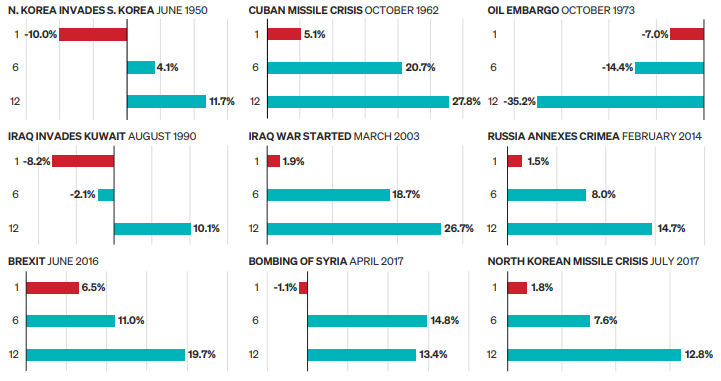

We have received many questions on the current market and how to respond to the Russian invasion of Ukraine. While the Russian invasion is top of mind for investors, these geopolitical events have proven to be short-lived and unpredictable. In a review of previous market shocks, we see that the market has largely shrugged off the geopolitical events.

Market volatility is common, and these bouts of volatility should not derail investors from their longer-term plans. While it is important to have a lifelong financial plan, it is more important to maintain discipline and restrain from allowing emotion to drive investment decisions when the market becomes challenging. Market volatility creates opportunity, and our team will seek to optimize those opportunities based on our long-term market objectives. History has shown that rebounds from market corrections are often quite robust, and it is the patient and long-term investors who are rewarded.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

2022 Meeder Investment Management, Inc.

3/1/22-22565