You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

» Fed Continues to Hike

» U.S. Economy Showing Mixed Signals

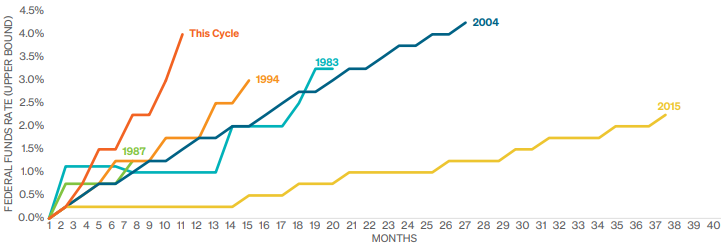

Prior to each recession in the U.S., the yield curve inverted when the 2-year Treasury yield exceeded the 10-year. This 2/10 inversion occurred earlier in the year, but this month the curve inverted even further when the 3-month Treasury yield exceeded the 10-year yield. So far, this is the most rapid rise in the effective Federal Funds rate of a rate tightening cycle that has occurred in the past 35 years. Investors are growing weary about the Feds ability to provide a “soft landing” to the U.S. economy by slowing growth without pushing it into a recession. According to Strategas, analyst consensus estimates for a recession occurring in late 2023 have risen to a probability of 60%.

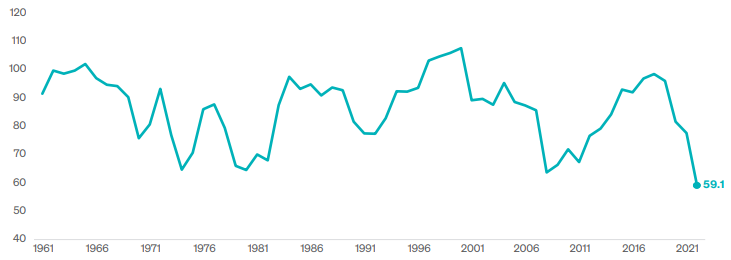

One indicator used to measure the current economic environment is the University of Michigan Index of Consumer Sentiment. This survey asks 500 U.S. households different questions that focus on their personal financial situation, as well as their view of the economy over the near- and long-term. The October level of 59.9 increased from the September reading of 58.6. However, the year-to-date average remains at the lowest level since the survey’s inception back in 1961. On the surface, it appears that this is a bad thing. Some investors look at consumer sentiment from a contrarian point of view and interpret this as a bullish signal that the market could be at an inflection point.

It is no surprise that higher interest rates have caused a slowdown in the housing market. According to the Mortgage Bankers Association, mortgage demand reached a seven year low as the average rate for a 30-year mortgage reached 7.14%, making it the highest level since 2001. Non-farm payrolls added 261,000 jobs to the U.S. economy this month, beating expectations of 200,000. It is positive that the economy continues to add jobs, but this was the lowest increase since December2020. Unemployment ticked up slightly from 3.5% in September to 3.7%.

Service oriented companies continue to grow but are showing signs of a slowdown according to the latest ISM Non-Manufacturing PMI Survey. The index fell from 56.7 in September to a level of 54.4 in October. This marks the slowest expansion that the services industry has seen since May of 2020. ISM Manufacturing PMI slowed month over month from 50.9 in September to a level of 50.2. For both indices, ISM levels above 50 signal expansion, and a level below 50 signals a contraction.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0116-MAM-11/14/22-13399