You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

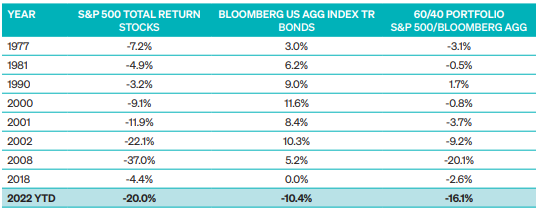

rates negatively impacted global equity and fixed income markets. The equity market officially fell

into bear market territory (down more than 20%) and “low risk” bond markets registered losses.

.png?h=800&iar=0&w=900&rev=0f19dde6612a4a2eb2eb1cdf0444788a&hash=89185FFE9F335EA14DF2DAA838D0F414)

For risk management we take a holistic approach, we want to know as much about each client’s financial situation as possible. The more information we have about their entire financial picture the more effectively we can manage their investments and ensure we are maintaining their specific risk profile. We can manage around concentrated positions, excluding stocks, sectors, or industries. All this information can be considered and allows our team to build the portfolio to be as effective and efficient as possible while maintaining the agreed-upon risk profile.

An area that we would consider to be one of the most underserved from a portfolio management standpoint is tax management, tax management often represents a large part of our conversations with advisors and clients. We implement active and ongoing tax-loss harvesting, as well as gain deferral when needed. The tax loss harvesting isn’t simply selling stocks that are down at the end of the quarter or the end of the year. This is a more thoughtful approach where every account is reviewed daily to determine if there are opportunities within the portfolio to harvest losses. This active tax management allows us to maximize after-tax wealth for our clients and generate tax alpha.

Finally, this is a transparent and unbiased approach. While Meeder does offer a full suite of mutual funds, we do not use any proprietary products inside of private wealth. Also, the clients will always be able to see in real-time the positions that are being held in the account, along with access to our investment team as needed to answer any questions that may arise.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0183-MAS-8/3/22-27338