You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

.png?h=1198&iar=0&w=2274&rev=a3a121a768a34936862087c14535f072&hash=A3B2DEC93CB64A8C64D282597DF14581)

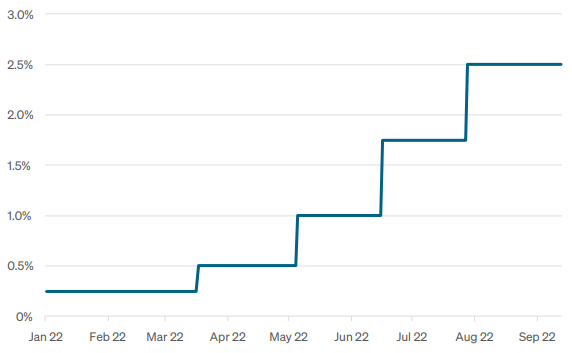

The equity market produced mixed performance results among growth and value styles but ended the month essentially flat. The S&P 500 Index is down -14% year-to-date, while bonds continue to struggle amid the Fed’s rising rate environment and declined -2% in August. This year, fixed income securities, as represented by the Bloomberg U.S. Aggregate Index, are having an incredibly challenging year and are down more than -10%.

The U.S. economy added 315,000 jobs in August exceeding market expectations of 300,000, but the unemployment rate rose slightly to 3.7%. Also, the BLS reported that 11.24 million job openings were available in July, which was 1 million more than estimated. This data indicates that the job market is still extremely tight in the U.S. with nearly twice as many job openings as there are available workers.

Oil prices continue to fall as worries of a global recession loom for investors. WTI crude ended August trading at $86 a barrel. While this decline is helping to ease the concerns of those focused on inflation, the long-term strength of the economy continues to be in question. Shortly after August, OPEC producers decided to implement a cut in production of 100,000 barrels per day.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0116-MAM-9/15/22-13399