You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

after finishing the second quarter down more than -20% from

its all-time high set on January 3rd. It was the worst first-half

performance for the S&P 500 since 1970. Bonds, represented

by the Bloomberg Aggregate Index could not escape the

carnage either as they also finished June down more than

-10% YTD.

.png?h=1198&iar=0&w=2274&rev=a3a121a768a34936862087c14535f072&hash=A3B2DEC93CB64A8C64D282597DF14581)

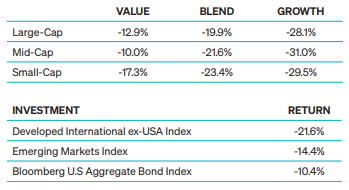

The second quarter was a continuation of many of the same themes as the first quarter this year, as illustrated in Figure 1. Value stocks outperformed their Growth peers and Large-caps generally outperformed Small-caps. When looking at the 9 style boxes, the performance of each of Russell’s 9 equity style indexes were negative. S&P sectors only had Energy produce positive performance year-to-date, up more than 30%. Utilities, Consumer Staples, and Health Care sectors each had single-digit losses year-to-date. The remaining sectors have experienced negative performance year-to-date, down anywhere from 16-32%. International markets suffered too, just as the global supply chain issues continue to struggle to meet demand.

Meeder Fixed Income portfolios started the second quarter with exposure to high yield bonds, investment-grade bonds, short-term U.S. Treasuries, and cash. As market volatility increased early in the quarter, momentum and volatility factors in our credit model signaled risk-off sentiment and we reduced high yield positions in our portfolios, moving the proceeds to cash. We also extended portfolio duration from mid-May through mid-June, as momentum factors in our duration model indicated relative strength in longer duration Treasuries. As volatility subsided towards the end of May, macroeconomic, momentum and volatility factors in our credit and emerging markets led us to increase high yield and emerging market exposure briefly.

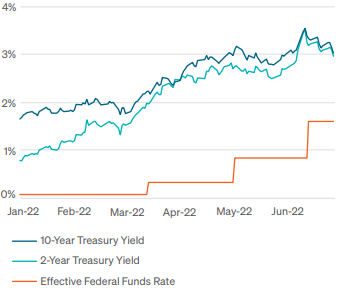

However, rate volatility in the fixed income markets continued to rise during the quarter and the Federal Reserve surprised the markets with a higher-than-expected, 0.75% rate hike on the federal funds rate in June. Our models ultimately guided us to exit high yield and emerging market positions in mid-June, increasing the cash position in our portfolios. Higher cash exposure helped our portfolios’ relative performance against market benchmarks on the downside during the quarter.

One-third of the portfolio remained invested in U.S. Investment grade securities throughout the quarter. At the end of the second quarter, we reduced High Yield and Emerging Market exposure and shortened the duration by raising cash.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third-parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third-parties. Advisory services provided by Meeder Asset Management, Inc. and/or Meeder Advisory Services, Inc. Meeder Funds are distributed by Meeder Distribution Services, Inc., member FINRA.

©2022 Meeder Investment Management, Inc.

0107-MIM-7/14/22-26925