You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

» Market Performance Recap

» Cracks In the Foundation?

» Key Differences: Late 2021 and Today

» Looking Forward

Canada and Mexico: Beginning March 4, 2025, the U.S. implemented a 25% tariff on all imports from Canada and Mexico, except for Canadian energy products, which are 10%. President Trump originally announced these tariffs at the beginning of February but delayed implementation by a month after Canada agreed to enhance security at their U.S. border and to appoint a fentanyl czar responsible for stopping the distribution of the drug into the United States. Mexico also agreed to place 10,000 troops along its U.S. border to stop drug trafficking. Tariffs on imports from Canada and Mexico could be especially impactful to the auto industry as these countries are very reliant upon one another in the design, manufacturing, and assembly of automobiles and parts.

China: President Trump implemented a 10% tariff on all Chinese imports on February 4th, but they were increased to 20% on March 4, 2025. President Trump was not happy with China’s progress in reducing the flow of narcotics from their country into the United States.

European Union: On February 26, 2025, President Trump announced plans to impose a 25% tariff on goods imported from the EU but has not announced an implementation date.

Global Tariffs on Steel and Aluminum Imports: The U.S. imposed a 25% tariff on all steel and aluminum imports beginning on March 12, 2025. This was designed to protect domestic industries but has raised concerns about potential increases in consumer prices and disruptions in global supply chains.

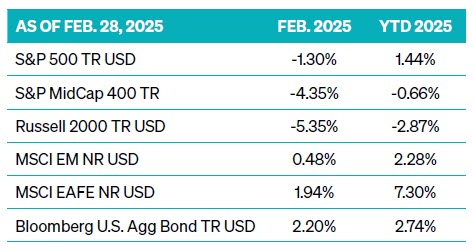

International equities offered some stability for investors. Developed international equities (MSCI EAFE Index) increased +1.94% for the month and are now up +7.30% year to date. Emerging market stocks (MSCI EM Index) climbed higher by 0.48%. Fixed income, as measured by the Bloomberg U.S. Aggregate Bond Index, gained 2.20% in February, bringing its YTD return to 2.74%.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicit, or recommend any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investors cannot invest directly in an index. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

Investment advisory services offered by Meeder Advisory Services, Inc.

INDEX DESCRIPTIONS

S&P 500 Index: The Index tracks the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies.

S&P 400 Index: The S&P MidCap 400® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500®, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

Russell 2000 Index: The Index is constructed to provide a comprehensive, unbiased barometer of the small-cap segment of the U.S. equity market. A subset of the Russell 3000 Index, it includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI EM Index: The Index captures large and mid-cap representation across 24 Emerging Markets (E.M.) countries. With 1,440 constituents, it covers approximately 85% of each country’s free float-adjusted market capitalization.

MSCI EAFE Index: The Index is an equity index that captures large and mid-cap representation across 21 Developed Markets countries* worldwide, excluding the U.S. and Canada. With 783 constituents, the index covers approximately 85% of each country’s free float-adjusted market capitalization. MSCI EM Index: The Index captures large and mid-cap representation across 24 Emerging Markets (E.M.) countries. With 1,440 constituents, it covers approximately 85% of each country’s free float-adjusted market capitalization.

Bloomberg U.S. Aggregate Bond Index: The Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate agency MBS, ABS, and CMBS (agency and non-agency). Provided the necessary inclusion rules are met, U.S. Aggregate-eligible securities also contribute to the multi-currency Global Aggregate Index and the U.S. Universal Index. The U.S. Aggregate Index was created in 1986, with history backfilled to January 1, 1976.

©2025 Meeder Investment Management, Inc.

0289-MAS-3/10/25-49400